What if I Don’t Have a Will?

Sometimes terrible things happen. Perhaps you’re in a car accident and you die from your injuries. Or perhaps you die from a prolonged struggle with a chronic disease.

Sometimes terrible things happen. Perhaps you’re in a car accident and you die from your injuries. Or perhaps you die from a prolonged struggle with a chronic disease.Terrible, yes. But, it’s even worse is to die that way without a Will or other estate planning.

A Will (or a Revocable Trust) is the only way to protect your family and choose what happens when you die. Without estate planning, you have LOST CONTROL and left your family at the whim of the legislature and courts.

If you don’t have a Will when you die, the State of Illinois has created one for you. While the legislative version of your Will may be better than nothing, I’ve never had a client create an estate plan that follows the plan created by the State of Illinois. It is doubtful that, given a choice, that you would pick the Illinois plan either.

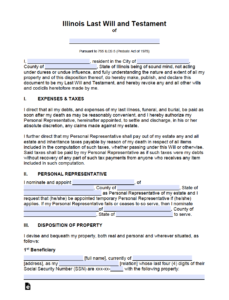

Download your Will by the State of Illinois

Let’s say that you have a wife and a couple of little kids.

If you don’t have a Will, the probate court will divide your property for you: one-half to your wife, and one-half to your children. Since your kids are minors, your wife will need to go to court to be appointed as their financial guardian, so she can manage the “gift” that the State gave them. The probate court oversees your wife’s investments and the expenses for your children, and she must report to the court each year.

The Problems with Doing Nothing

Once your children reach age 18, they immediately get their gift, outright with no strings attached.

Further, since you don’t have a Will, the fees relating to your estate will be higher, and you will have lost the opportunity to minimize your death taxes.

Maybe you think that this doesn’t apply to you. You don’t need one because you own your home as joint tenants with your spouse, and your spouse is the beneficiary of your insurance and retirement accounts. That’s good enough, right?

The Problems with Joint Ownership

No. No. A hundred times No!

At best, joint tenancy ONLY works on the death of the first spouse to die. If your home is owned as joint tenants with your wife, when you die the home goes to your wife — but THEN WHAT? If your wife doesn’t have a Will and if she dies shortly after you, then your family is back to the “No Will” problems.

You probably want your home and other assets to go to your wife, if she survives you, and then to your children on her death. But joint tenancy is a gift to your wife only, not to your children.

Once you die, your wife can do whatever she wants with your property. There is no guarantee that your property ends up with your children. If your wife remarries, there is nothing to stop her from giving the house to her new husband. If your kids don’t get along with their new step-father, perhaps he’ll throw them out.

Who knows what bad things can happen if you give up control?

To die without a Will is a terrible burden on your family. I’ve seen first hand how difficult it is to cope with both the death of a loved one and the uncertainty of the probate process without a Will.

Do yourself and your family a favor. Investigate getting a Will right now, before it’s too late. I’d be happy to help.

Download your Will by the State of Illinois

Categories: Estate Planning

Advance Care Directive Regarding Dementia Match the Lyrics! – The Promised Land

Contact John

30+ Years Experience.

Personal Planning.

Plain English.

Committed to simplifying your estate planning. Let's work together to achieve your

peace of mind.

John Varde, Attorney

180 North LaSalle, Suite 2650

Chicago, Illinois 60601

Get Started Today

If you’re ready to take the next step, download the free Confidential Estate Planning Questionnaire